Difficult Paper Lbo Example

What is an lbo model.

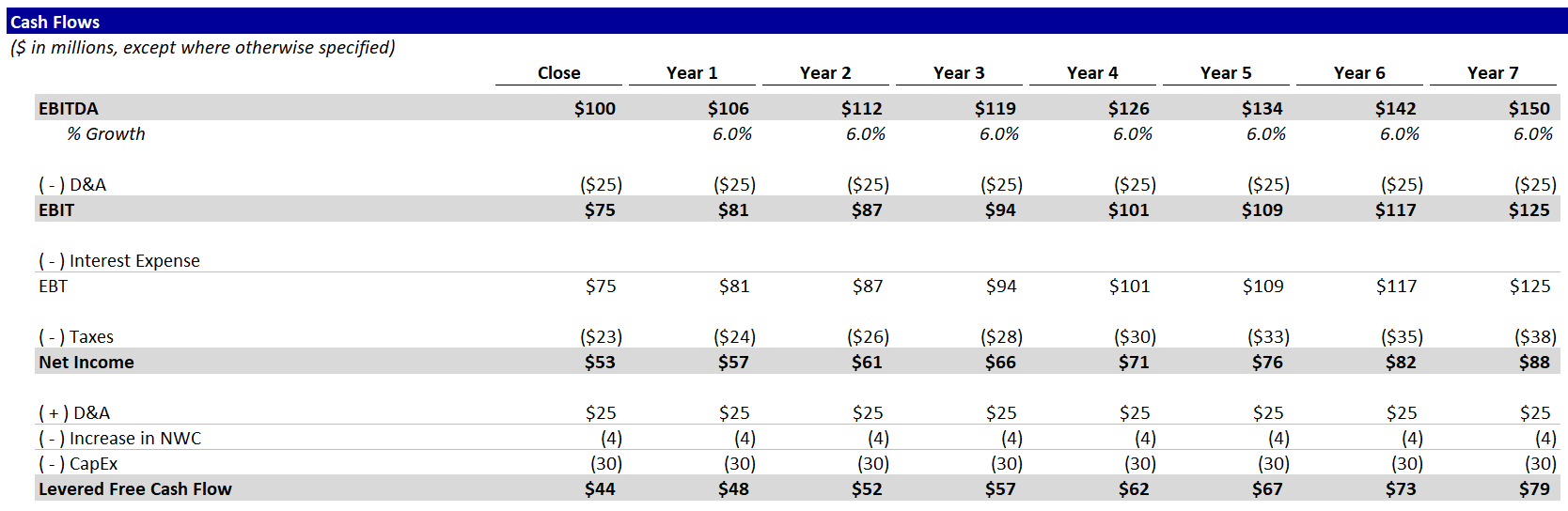

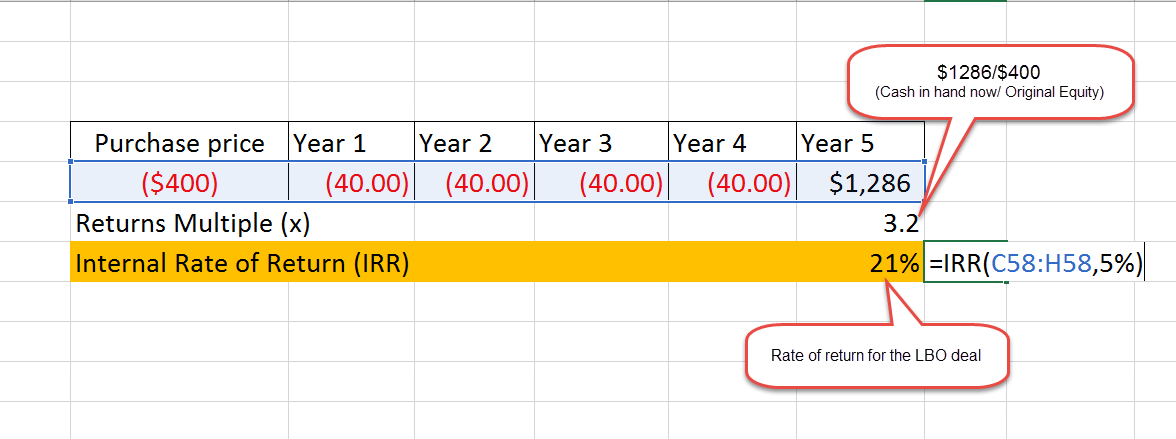

Difficult paper lbo example. Most paper lbos are of 5 year period so you can use the table below to approximate the irr. Paper lbo model example. Now this paper lbo also shows you exactly how much of the value is created from the company s operations vs. The reason is that you can easily calculate the moic on paper but it s difficult to calculate the irr without a calculator.

Paper lbo model example 436 views. In a paper lbo exercise you will be expected to complete the important components of a working lbo model with the use of paper and pencil and without the use of a computer. You may have to calculate simplified debt paydown and returns calculations by hand. If we used zero debt in the transaction we would have spent 500m in equity capital upfront and received 700m at exit for a net return of 200m which is a 40 return over 5 years or an.

Paper lbo often in pe interviews in addition to a full blown excel modeling test interviewers will grill candidates on lbo mechanics in person. To help you prepare for paper lbo tests. The trick is to use the moic as a proxy for irr. 2 comments 0 likes statistics notes full name.

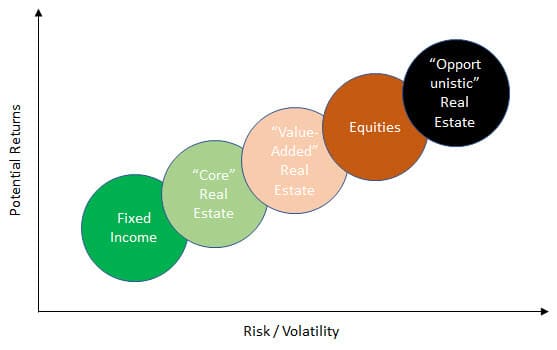

Clearly state the simplifying assumptions you are making and their implications. An lbo transaction typically occur when a private equity pe firm borrows as much as they can from a variety of lenders up to 70 80 of the purchase price to. From juicing returns using leverage debt. Most paper lbo exercises that you encounter will be simpler than this one.

Follow published on jun 9 2018. We re buying it at the end of year 0 at 10x ltm ebitda multiple. Ebitda margin is 20 in year 0 and remains constant throughout the holding period. Private equity paper lbo example standard a step by step walk through.

Using a 5 0x entry multiple calculate the price. An illustrative example of a paper lbo is provided below in 5 simple steps. These are called paper lbos here s an example paper lbo. An lbo model is built in excel to evaluate a leveraged buyout lbo leveraged buyout lbo a leveraged buyout lbo is a transaction where a business is acquired using debt as the main source of consideration.

This type of paper lbo test is an interview exercise you will be facing often multiple times in the course of a private equity recruitment process. Paper lbo example the prompt the company has a year 0 revenue of 500 growing at a rate of 10 every year. Make sure you are able to go through this exercise reasonably quickly and without the help of excel or a calculator.

:max_bytes(150000):strip_icc()/GettyImages-540832466-8100430ae13444b2a8d389c92f37e147.jpg)